Mumbai3 hours ago

- copy link

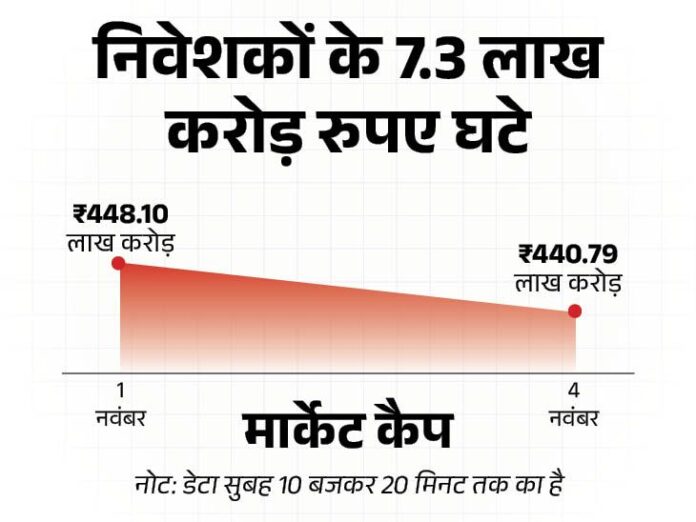

There is a fall of about 1300 (1.60%) in Sensex today i.e. on Monday (4 November). It is trading at 78,400. Nifty is also down by more than 400 points (1.80%), it is trading below 23,900.

Nifty Media and Oil & Gas index has fallen the most by 3%. There is also a decline of about 3% in the realty index. The metal index is down 2.5%. The index of auto and government banks is down 2%. There is a decline of about 1% in Pharma and IT indices.

4 reasons for market decline

- Voting for the US presidential election will take place on November 5. The market is cautious before the formation of a new government.

- The upcoming US Federal Reserve policy on November 7 is also increasing apprehensions in the Indian market.

- Disappointing second quarter earnings from Indian corporates are contributing to the market decline.

- Foreign investors sold shares worth ₹1.2 lakh crore in October. This has created negative sentiments.

China's Shanghai Composite Index rose 0.50%

- In the Asian market, Japan's Nikkei is closed today, Korea's Kospi is up 1.50% at 2,580, while China's Shanghai Composite is up 0.50% at 3,289.

- On November 1, the US Dow Jones Industrial Average rose 0.69% to 42,052 and the S&P 500 index closed 0.41% to 5,728. At the same time, Nasdaq rose 0.80% to 18,239.

- According to NSE data, foreign investors (FIIs) sold shares worth ₹211.93 crore on November 1. During this period, domestic investors (DIIs) also sold shares worth ₹1377.33 crore.

Market may fall to 23,500 level According to experts, Nifty is consolidating within the 24,000-24,500 range. Ajit Mishra, SVP, Research, Religare Broking said – If Nifty crosses 24,500, it can go up to the level of 24,800.

Whereas if it goes below 24,000, the index may see a level of 23,500. Harshubh Shah, founder of Wealth View Analytics, has also predicted a correction in the market. He has advised investors to avoid buying.

Afcons Infra shares listed down 8% Afcons Infra shares had weak listing in the market today. It was listed on NSE at Rs 426 per share with 8% discount. It is listed on BSE at Rs 430.05 per share with a discount of 7.1%. Its issue price was Rs 463.

Sagility India's IPO will open from tomorrow The Rs 2,106.60 crore IPO of Sagility India, which provides healthcare focused solutions and services, is scheduled to open on November 5. Money can be invested in this till 7th November. Anchor investors will be able to bid on November 4. The allotment will take place on November 8 after the issue closes. The listing of shares will take place on BSE and NSE on November 12. Read full news

Sensex rose 335 points in Muhurat trading On the occasion of Diwali, one hour Muhurta trading took place in the stock market on 1 November. Sensex closed at 79,724 with a gain of 335 points. At the same time, there was a jump of 99 points in Nifty and it closed at 24,304.

After trading, out of all 30 Sensex stocks, 26 were up, while 4 were down. At the same time, 42 out of 50 Nifty stocks saw a rise and only 8 saw a rise.

Also read this business related news…

There may be a big fall in the stock market: FIIs sold shares worth ₹ 1.2 lakh crore, 5 factors will decide the movement of the market.

There may be a decline in the stock market in the week starting from 4th November. This week, investors will keep an eye on companies' quarterly results, global and domestic economic data and other factors.

According to market expert Harshubh Shah, there may be a market crash in the coming days, hence one should avoid buying now. Shah had advised investors to stay away from the market even on the day of Muhurta trading. Read the full news here…