New Delhi7 hours ago

- copy link

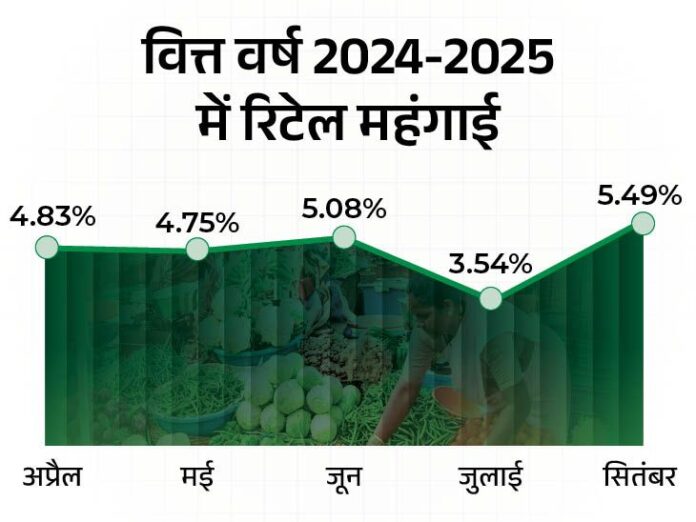

Due to costlier food items, retail inflation has increased to 6.21% in October. This is the highest level of inflation in 14 months. The inflation rate in August 2023 was 6.83%. Whereas in September, a month before October, this rate had reached 5.49% due to the cost of vegetables.

Food items contribute about 50% to the inflation basket. Its inflation has increased from 9.24% to 10.87% on month-on-month basis. Whereas rural inflation has increased from 5.87% to 6.68% and urban inflation has increased from 5.05% to 5.62%.

How does inflation affect?

Inflation is directly related to purchasing power. For example, if the inflation rate is 6%, then Rs 100 earned will be worth only Rs 94. Therefore, investment should be made only keeping inflation in mind. Otherwise the value of your money will reduce.

How does inflation increase and decrease?

The rise and fall of inflation depends on the demand and supply of the product. If people have more money they will buy more things. Buying more things will increase the demand for things and if the supply is not as per the demand, the price of these things will increase.

In this way the market becomes vulnerable to inflation. Simply put, excessive flow of money or shortage of goods in the market causes inflation. Whereas if demand is less and supply is more then inflation will be less.

Inflation is determined by CPI

As a customer, you and I buy goods from the retail market. The work of showing the changes in prices related to this is done by the Consumer Price Index i.e. CPI. CPI measures the average price we pay for goods and services.

Apart from crude oil, commodity prices, manufactured costs, there are many other things which play an important role in determining the retail inflation rate. There are about 300 items on the basis of whose prices the retail inflation rate is decided.

Read this news also…

Gold fell by ₹ 1,519 to ₹ 75,321: Silver became cheaper by ₹ 2,554 and was being sold at ₹ 88,305 per kg, see the price of gold according to carat.

There has been a big fall in the prices of gold and silver today (12 November). According to India Bullion and Jewelers Association (IBJA), the price of 10 grams of 24 carat gold fell by Rs 1,519 to Rs 75,321. Earlier its price was Rs 76,840 per ten grams.

At the same time, the price of silver also declined today. It fell by Rs 2,554 to Rs 88,305 per kg. Earlier silver was at Rs 90,859. At the same time, on October 23, silver had made an all-time high of Rs 99,151 and on October 30, gold had made an all-time high of Rs 79,681. Read the full news…

-

Market fell 1145 points from the day's high: Sensex fell 820 points and closed at 78,675, Nifty also fell 257 points.

- copy link

share

-

Jinka Logistics Solutions IPO will open from tomorrow: Investors will be able to bid till November 18, minimum investment will be Rs 14,742.

- copy link

share

-

Gold fell ₹1,519 to ₹75,321: Silver became cheaper by ₹ 2,554 and was being sold at ₹ 88,305 per kg, see the price of gold according to carat.

- copy link

share

-

Sazility India shares listed at ₹31.06, up 3.53%: The issue price of IPO was ₹30, the company provides healthcare focused solutions and services.

- copy link

share