Several banks are suffering from liquidity crisis. They are not able to return the money kept by the customers on time. Even though there is enough money, some banks are not able to distribute loans because the country's investment situation is not good. As a result, credit growth in the private sector fell to the lowest in 11 months.

LC opening rates are also steadily declining despite the two-year volatile dollar market that seems normal. Again, the price of goods in the market is not decreasing. The increase in the price of several products, including eggs, is being criticized on social media. Although the government is saying that inflation is now on the downward trend.

Many of the victims say that banks have started harassing them in the same way that insurance companies used to harass them earlier. Many customers are being harassed while withdrawing one lakh or two lakh rupees. Even a check of 10000 rupees has developed a trend in some banks.

The same is the case with non-bank financial institutions. Not only that! Islami Bank, which was known as one of the most stable banks in the country a decade ago, i.e. in 2014, is now in a miserable state. A middle-ranking official of the bank told the Bangla Tribune that their long-standing reputation is being destroyed due to the cash crisis.

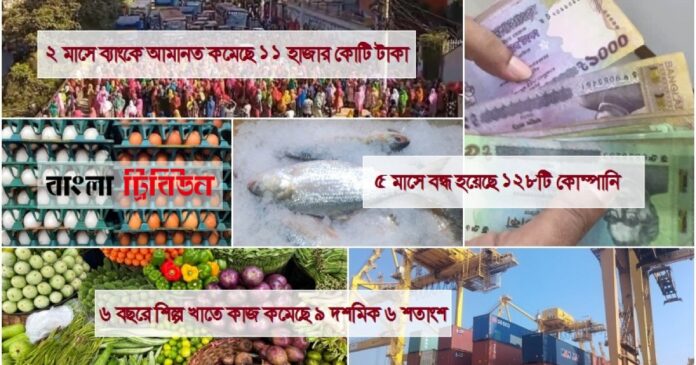

According to the data of Bangladesh Bank, in the first two months (July-August) of the current financial year 2024-25, the deposits have not increased but on the contrary decreased. During this period, deposits in the bank sector decreased by about 11 thousand crores. In the recent past, such a decrease in deposits in the bank sector has not been seen.

According to the data of Bangladesh Bank, the balance of deposits in the bank sector at the end of last June was 17 lakh 42 thousand 797 crores. At the end of August, the balance of deposits has come down to Tk 17 lakh 31 thousand 890 crore. According to that, in the first two months of the current financial year, the deposits have decreased by 10 thousand 907 crores.

According to the report, deposits in the bank sector increased by Tk 23 thousand 254 crore in the first two months of the previous financial year (2023-24) in July-August. The liquidity crunch has intensified as deposit flows in the banking sector have turned negative. Especially the most distressed banks are now unable to collect deposits even by offering 14-15 percent interest. Every day panicked customers are flocking to different branches of these banks to withdraw their deposits. In most cases, the customers have to return disappointed.

Meanwhile, the government has to keep taking money from the bank without increasing the revenue due to various reasons besides the political instability. It is shrinking investment in the private sector, not increasing employment.

The pressure will be one year

The World Bank said that the economy of Bangladesh will remain under pressure for another year. According to the organization, political uncertainty, deteriorating law and order situation and labor unrest in the industrial sector are the three main obstacles to the normalization of economic activities in Bangladesh. According to the Bangladesh Development Update Report published on Tuesday (October 15), there are several challenges in Bangladesh's economy at the moment. Among these are high inflation, external pressures from other sectors, financial sector weakness and political uncertainty. Due to these reasons the growth will not increase much.

The agency said there are major challenges in creating employment in the institutional sector in Bangladesh. Because still 84.9 percent employment is in informal sector. This is a very high number. Between 2016 and 2022, employment in the manufacturing sector declined by 9.6 percent.

In this context, Dhaka Chamber President Ashraf Ahmed said that our private sector is facing various problems including devaluation of money, high inflation, lack of foreign currency reserves, high interest rates of bank loans and obstacles in opening loans. He said, due to the procedural complexity and lengthy process in the importation of the port, the imposition of various types of fines, our business costs are constantly increasing.

Investment is low, companies are closing down

Due to the lack of investment confidence, the lending activities of the country's banking sector have come under pressure. Due to the dollar crisis, investments were stagnant for the last two years. The situation worsened after the formation of the interim government.

In addition, the bank's letter of credit (LC) opening rate is also continuously decreasing. According to Bangladesh Bank data, LC opening fell by around 13 per cent in July-August of FY 2024-25 and imports of capital equipment fell by 44 per cent. In the parlance of economics it indicates stagnation in business expansion.

According to the Directorate of Joint Capital Companies and Firms (RJSC) data, 128 companies closed in the last 5 months (May to September). Among them, 46 companies were completely closed in August alone. In the following month, September, 26 companies were closed. In the three months of July-September, 83 companies were completely shut down.

Many business patrons have already left the country, leaving the overall business situation at a standstill.

Incidentally, since 2022, investment flows have been sluggish due to the dollar crisis, high inflation and global economic instability. Stakeholders say the current political uncertainty is compounding the situation, further reducing investor confidence.

Banks are currently not receiving any new investment proposals from local or international investors. Due to high inflation, consumer demand is also decreasing. In this situation, banks and investors are following the 'wait and watch' policy, bankers said.

In this context, Syed Mahbubur Rahman, Managing Director of Private Mutual Trust Bank, told Bangla Tribune that since the beginning of the dollar crisis in 2022, the investment situation has been slow. It has worsened since July this year. We are seeing a steady decline in LC opening rate which indicates stagnancy in investment. The biggest problem is that banks are suffering from liquidity crunch and foreign investment is not coming in amid the current uncertainty. In this scenario, banks are more inclined to invest in government bonds rather than lending to the private sector to avoid risk. As a result, private sector credit growth is decreasing.

According to Bangladesh Bank data, the country's private sector credit growth fell from 10.13 percent in July to 9.86 percent in August, which is the lowest in the last 11 months. Earlier, the growth rate was 9.69 percent in September 2023 and 9.75 percent in August.

Meanwhile, in July and August, the revenue collection in the country has fallen by more than 15 thousand crore rupees from the target. Not only the target, but the revenue collection is also lower than the same period of the previous year. According to the National Board of Revenue (NBR), the government's revenue collection in the first two months of the current financial year (July-August) was 42 thousand 106 crores, which is about 15 thousand 69 crores less than the target. In the same period of the previous year, the revenue was 47 thousand 562 crores. That is, the revenue collection has decreased by 11 percent in the first two months of the current financial year compared to the same period of the previous financial year.

Government borrowing from commercial banks has almost doubled in the first three months of the current financial year as compared to the same period of the previous financial year due to lower revenue.

According to the Central Bank report, the government has borrowed 47 thousand 209 from commercial banks during July-September of the current financial year. At the end of the same period of the last financial year, the government borrowed 24 thousand 474 crores from commercial banks. That is, government borrowing from commercial banks has increased by almost 93 percent in a span of one year.

After the political change, labor unrest began in the garment industry, the top export sector. Due to this, production was disrupted for the last one and a half months in the factories of Ashulia in Savar. Protests took place in some factories in Gazipur. Still, Bangladesh's product exports increased last month. That is, this indicator of the economy has returned to a positive trend.

Export earnings increased

According to the Export Development Bureau (EPB), the country's export income increased by 6.78 percent to 3.52 billion dollars in September. It was $3.29 billion in September 2023. On the other hand, during the July-September period of the current financial year, the export income has increased by 5.04 percent to 11.37 billion, which was 10.82 billion in the same period of the last financial year.

Export earnings from the ready-made garments sector increased by 5.43 percent to 9.28 billion during July-September of the current financial year, which was 8.81 billion last year. On the other hand, the apparel sector earned $2.78 billion in September, an increase of 6 percent. Export earnings from oven products rose 8.2 percent to $1.18 billion. Where the export income of net goods increased by 4.40 percent to 1.60 billion dollars.

Last September, the income from the export of agricultural products was 97 million dollars. Here the growth has been 16.82 percent. Plastics products generated $27 million in revenue, up 32.5 percent from $21 million in the same period a year ago.

Meanwhile, another indicator of the economy, the flow of expatriate income continues to be positive. The total remittance or expatriate income in the last month of September exceeded US$ 200 million. This year's second highest revenue came last month and saw 80 percent growth.

According to the data obtained from Bangladesh Bank, the total expatriate income in the month of September was 2.40 billion dollars or 240 million dollars. Last August the revenue came to 222 million dollars. In September last year, the expatriate income was 1.33 billion dollars. As such, expatriates sent 80 percent more money to the country last month compared to the same period last year.

According to sources concerned, the foreign exchange reserves are under severe pressure due to money laundering by influential people of the outgoing government and rising import costs post-Covid-19 due to global and domestic factors. However, the recent increase in expatriate income and exports is helping to increase foreign exchange reserves.

According to the latest data of the central bank, as of October 8, gross (total) reserves are two thousand 497 million US dollars or 24.97 billion dollars. And according to the International Monetary Fund (IMF) accounting method BPM-6, the reserve is now one thousand 982 million dollars (19.82 billion). In the previous week i.e. on October 2, gross reserves were 24.74 billion and BPM-6 was 19.76 billion dollars. As such, the reserves have increased slightly. The central bank has stopped selling dollars from the reserves as before.

Bangladesh Bank Governor Dr. Ahsan H Mansoor recently said in an event that four-five families have taken two lakh crore rupees from the bank. It could have caused a recession in the economy, but it didn't. Selling dollars from central bank reserves will lead to a situation like Sri Lanka after six months. It cannot be a solution. For this we have to suffer for some time.