Bangladesh already had the opportunity to submit income tax returns online, but the National Board of Revenue (NBR) has made it easier than ever to submit returns online. The organization has opened online income tax return filing service for everyone. It also encourages taxpayers to file their returns online. Now any tax payer can register online and submit income tax return for this year from the comfort of his/her home. Those concerned say that if returns are submitted online, taxpayers and NBR tax officials will not meet directly. It is expected to reduce corruption. On September 9, NBR launched the online system for filing returns for the fiscal year 2024-25. Since then till November 16, the number of online income tax return submissions has crossed 375 thousand.

Individual taxpayers can file income tax returns from July 1 to November 30 every year. This year the return filing period has already been extended by one month. Accordingly, the last date for submission of returns is 31 December. An average of 8,000 e-returns are now being submitted every working day. Seeing the strong interest of taxpayers in filing returns online, NBR expects that at least 15 to 16 lakh returns will be filed online in the current financial year. NBR's slogan in this regard is, 'Don't stand in line, return online'.

Currently there are about 1 crore 5 lakh Tax Identification Number (TIN) holders. An average of 40 lakh TIN holders submit returns every year. This number may increase this time.

Chairman of National Board of Revenue (NBR) said that mobile app will be launched for submitting income tax returns next year to make it easier to submit returns online. Abdur Rahman Khan. He said this after inaugurating the help desk for the convenience of passengers at the customs area of Hazrat Shahjalal International Airport on November 17.

Md. Abdur Rahman Khan said that the tax payment process will be fully automated. Mobile app for tax returns will be launched next year.

He said all corporate tax returns will be made online by next year. At present returns are being submitted online at the individual level. It will also be introduced at the corporate level in the future. The chairman said that NBR is working to reduce the direct contact of the people with the tax officials.

He said that payment of tax through debit and credit cards has been made easier. Paying tax below 25 thousand rupees on the card will cost 20 rupees. Any amount above this is a maximum of 50 rupees.

As per NBR rules, a person has to pay income tax if his annual income is more than 3 lakh 50 thousand rupees. However, the tax-free income limit for women and citizens above 65 is Tk 4 lakh. And it is five lakh taka for the war wounded freedom fighters.

Apart from this, income tax is also payable on previous tax assessment, city residence, car ownership, membership of certain professions, running a business and participating in tenders or elections. This also applies to registered companies and NGOs.

Having a Taxpayer Identification Number (TIN) requires you to file an income tax return whether you have taxable income or not. A nil return can be filed if there is no taxable income. If you don't do that, there are punishments and fines in the law.

Meanwhile, online submission of returns has been made mandatory for some areas and sectors for the first time. NBR has issued a special order in this regard on October 22. As a result of this order, from now on all the government employees of the income tax circles of Dhaka and Gazipur and Narayanganj City Corporation and all the scheduled bank employees of the country will have to file their returns online. Besides, employees of telecom service providers and some multinational companies have also been made mandatory. In a recent video message, Chief Adviser Professor Dr. Muhammad Yunus urged individual tax payers across the country to submit their returns by “depositing income tax at home”.

According to NBR data, it is now possible to file returns online, collect return receipts and tax certificates, make e-payments and verify e-returns from home. Any tax payer can pay tax along with filing return through internet banking, debit and credit card and mobile banking. Apart from this, taxpayers can download and print copies of returns filed, receipts, income tax certificates, tax identification numbers (TINs) from the same online system.

Registration must be done first

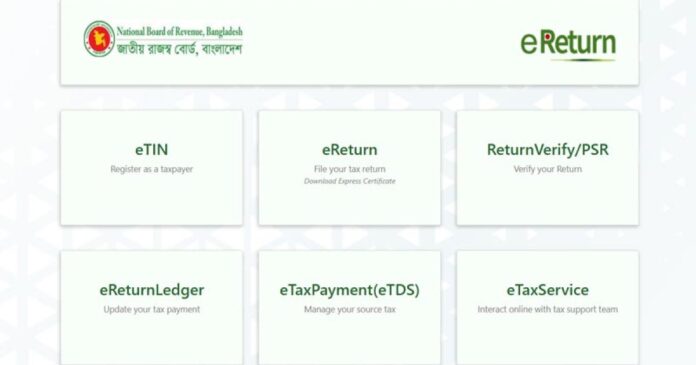

Online return filing process requires registration or registration using e-return option of NBR website www.etaxribr.gov.bd portal. This requires Taxpayer Index Number or TIN and 'Biometric Verified' mobile phone number.

Biometric SIM registered with taxpayer's own national identity card is required for successful registration in e-return. To verify whether the mobile number used by the taxpayer is biometrically registered with his National Identity Card, dial *16001#.

To register, click on the e-returns section of the website. Go to the 'Sign Up' option and enter your TIN number in the first box. In the second box, enter the biometrically registered mobile number on the national identity card (omitting the first zero). Then click on 'Verify' button with captcha code. Finally a password has to be entered to log into the e-return system to confirm the phone number using the OTP sent to the phone.

Submission Options

After registration, sign in and go to the 'Submission' option on the dashboard. In this option 'Regular e-Return' and 'Single Page Return' category have to be selected.

If the seven conditions like taxable income not exceeding five lakh rupees, not being a government employee are met, the process of filling single page or one page return should be proceeded.

Keep all the information handy and fill it

There is no obligation to enter the website and fill all the information at once. There is an opportunity to keep it as a draft and fill it in at a later time. In this context, income tax lawyer Golam Mostafa said that all information and documents should be prepared and kept at hand and then data entry should be done.

What will it take?

In case of employees, salary earning documents, rent receipts and contract documents, local tax receipts, asset sale documents, tax deduction certificate at source, bank account details, ETIN, copy of national identity card, copy of previous returns etc. If there are multiple sources of income, the necessary documents must be collected. Investment details, property information and tax free income certificate should be included. However, taxpayer need not submit or upload any documents to file e-return online. Just submit the required information.

Tax Assessment Information

At the beginning of the e-return form there will be 'Tax Assessment Information'. All income tax related information – return scheme, year and source of income should be given there. If the income is exempt from tax, 'Resident Status' has to be given along with the amount of income.

Heads of Income

Go to 'Heads of Income' and enter various sources of income. Here you can include salary, security interest, income from house-property, agricultural income, income from business, capital gains and income from other sources.

If salary is the only source of income, click on 'Salary' option. If there is income outside of this, click on 'Income from Other Sources' option and click on the other sources of income.

Then click on the 'Save and Continue' option to proceed to the next step

Select the primary source of income from the dropdown menu. There will be many options like Dhaka North City Corporation, Dhaka South City Corporation, Chittagong City Corporation.

If a war casualty freedom fighter, disabled or legal guardian of a disabled person, that can also be included here. Besides, whether claimant of tax exemption for investment, shareholder or director of a company, answer by 'Yes' or 'No'.

IT10B if the assets are more than 40 lakh rupees

If the assets amount to Tk 40 lakh or more, then the expenditure section of the statement form must be filled. For this 'IT10B Form' has to be filled. If the amount of assets is less than 40 lakhs then it need not be filled.

'Any other' income

Give details of income from other sources, foreign income or tax-exempt income. Click on various options in the dropdown menu to provide information about income from sources other than salary or taxable investments.

Clicking on 'Any Other Income' option will provide the source of other income, paying authority, date and amount of last income received, and related expenses. After giving these information, net income calculation will be shown.

DPS

If currently invested in Life Insurance Premium, Deposit Premium Service (DPS), Approved Savings Certificate, General Provident Fund, Benevolent Fund, Group Insurance Premium, Approved Stocks or Shares, or other categories, they should be mentioned here. On clicking on 'DPS' option you have to give bank name, account number and deposited amount.

Cost information

You can review total expenses against total income. There will be categories of expenditure in different sectors. Food, clothing, accommodation (including transport, household goods, utilities), children's education and any other expenses can be included if applicable. Filling these details will calculate the due tax.

advance tax

If you have already paid any source tax and advance tax, you can give the details. After this calculation the total amount of tax payable will be reduced automatically. If there is no tax due on the income, your tax payable will be nil. This is called 'zero return'.

Online returns

Click on 'Online Return' option to view the return form. Clicking on 'Yes' option below it will submit the return. If you have doubts about any information, you can click on 'No' option and check all the information again.

Download the receipt

If the income tax return is submitted successfully, you will see a congratulatory message. There will be an option to download a reference ID. You can download it and file income tax return online. Or you can print it and send it to Income Tax office.