'Debt is a human right as it relates to people's livelihood. You cannot establish the right to livelihood without securing the right to credit'.

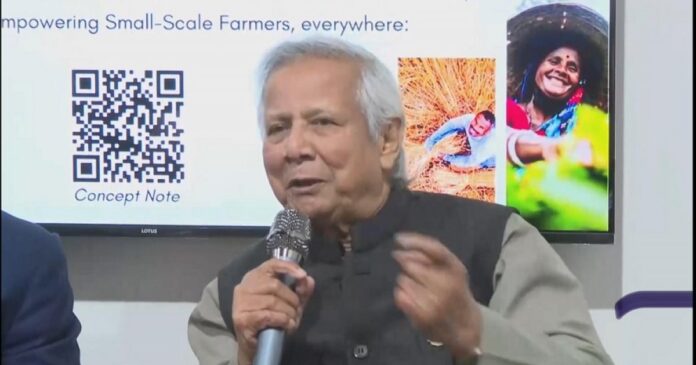

Chief Adviser to the Interim Government Professor Muhammad Yunus made the comments while speaking at a side event at COP29 in Baku, the capital of Azerbaijan.

Bangladesh and the Netherlands jointly organized an event titled 'A Global Conversation: Access to Finance for Small Scale Farmers' at the Bangladesh Pavilion of the conference. Additional Foreign Secretary Riyaz Hamidullah presided over the event, which was also attended by Dutch Prince Jaime Bernardo of Bourbon-Parma, Climate Ambassador of the Netherlands. This information has been reported from the press wing of the Chief Adviser.

Professor Yunus said that a farmer can become an entrepreneur if he is given credit.

“Every business needs money and investment. A farmer not only produces crops but also sells them in the market,” he said.

Professor Yunus, who is globally acclaimed as a pioneer of microcredit, said if he was given credit, he would be able to improve his life by buying and selling crops from other farmers. Countries need to redesign the banking system following the Grameen Bank model, so that credit is available to farmers.

The Dutch prince highlighted how credit, insurance, investment, research and financing have boosted agricultural production, saying millions of farmers around the world now need this support.

Yvonne Pinto, director general of the International Rice Research Institute, said at the event that global rice production has increased since credit was extended to farmers.

Jorim Schraven, director of the Dutch entrepreneurial development bank FMO, praised Prof. Yunus for his moral support for credit rights.