- Hindi News

- Business

- SEBI F&O Guidelines; Futures Options New Rules Regulations Criteria Update

New Delhi2 hours agoAuthor: Aditya Mishra

- copy link

It is about June 2024. Roshan Aggarwal is Assam based CA. A B-Tech third year student came to him to file income tax return. He had suffered a loss of Rs 26 lakh in Futures and Options (F&O) trading in 2023-2024, but had no source of income. Even a year ago that student had suffered a loss of Rs 20 lakh.

Even parents are not aware of this loss. The parents have separated. Mother runs a hotel business. He took personal loans from microfinance mobile apps for futures and options trading, borrowed money from friends, and even withdrew money from his parents' accounts without informing them.

CA said- The student was taking his financial decisions under the influence of social media and friends. One of his friends had earned Rs 1 crore from F&O trading last year. When the CA asked the student why he did not leave trading, the student said that he had become addicted to it and was unable to leave it.

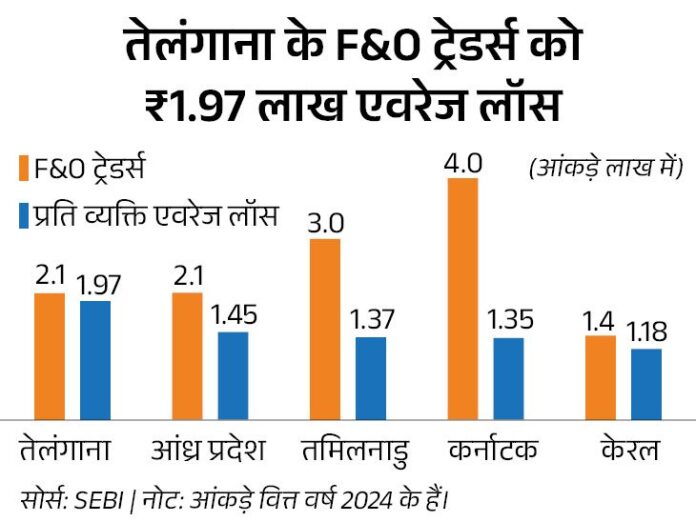

This is not the story of just one person, a recent SEBI report shows that 93% i.e. 93 out of every 100 traders trading in the F&O segment are in loss. Between financial year 2022 and 2024, 93 lakh out of more than 1 crore F&O traders have lost Rs 1.8 lakh crore. The proportion of traders under 30 years of age doing F&O trading has increased from 31% in FY23 to 43% in FY24.

SEBI's new circular to protect retail investors from losses, three big things…

1. Upfront Collection of Premium from Option Buyers: Option premium will be collected upfront from option buyers. Most brokers are already following this rule, but those who are not will also have to do so. This rule will come into effect from 1 February 2025.

2. Contract size increased for index derivatives: SEBI has increased the contract size for index futures and options from Rs 5-10 lakh to Rs 15 lakh. That is, now buyers will have to pay more for one lot, this rule will be effective from November 20, 2024.

3. Limiting expiry to one per exchange: Weekly index expiry is limited to one per exchange. That is, the expiry of indices like Nifty, Bank Nifty, Nifty Financial will be on the same day. Earlier this used to happen on different days of the week.

Lot size of Nifty 50 increased from 25 to 75

Following the order of market regulator SEBI, the National Stock Exchange (NSE) has increased the lot size of all its five index derivative contracts. The lot size of Nifty 50 has been increased from 25 to 75, which is an increase of 3 times.

The lot size of Nifty Bank has been increased from 15 to 30. SEBI hopes that this step will reduce the participation of retail investors in F&O. The new lot sizes will be applicable from 20 November 2024.

65% to 85% of brokers' revenue comes from F&O Stock brokers generate most of their revenue from futures and options trading which is around 65% to 85%. Recently, Nitin Kamath, founder of brokerage firm Zerodha, had said that the revenue of brokers can be badly affected due to the regulator change restricting SEBI F&O.

Demat accounts increased 4 times between 2019 to 2024 Ten years ago, i.e. in 2014, the number of demat accounts was around 2.25 crore. In the next 5 years i.e. in 2019, this number reached 3.6 crores. But in the next 5 years i.e. from 2019 to 2024, this number increased almost 4 times to more than 17 crores.

However, the demat account cannot be directly linked to the number of investors. This is because an investor can have multiple demat accounts. Still, this gives a rough idea of the number of investors that are moving into the market.

What are futures and options? Futures and Options (F&O) are a type of financial instruments that allow an investor to take large positions in stocks, commodities, currencies with less capital. Futures and options are a type of derivative contracts that have a fixed term.

Within this time frame, their prices change according to the stock price. Futures and options on each share are available in one lot size.

Intraday trading is the buying and selling of shares within the same trading day. Intraday trading is also called day-trading. In this, buying and selling of shares takes place within the same trading day. The price of shares keeps changing continuously during the trading day. In such a situation, intra-day traders earn profits from stock fluctuations in the short term.