Expatriate Bangladeshis have withdrawn the ceiling on investment in US Dollar Premium Bonds and US Dollar Investment Bonds in Wage Earner Development Bonds. At the same time the automatic reinvestment facility has been further rationalized.

A notification in this regard has been issued by the National Board of Revenue on Sunday (November 3). This order will be effective from December 1.

In addition, the notification provides for the benefit of pensioners to give monthly profit instead of quarterly profit to the pensioner's savings account for the benefit of the pensioners, in addition to providing opportunities for investment in wage earner bonds for non-resident Bangladeshi mariners, pilots and cabin crew working in foreign offices of foreign-owned shipping or airline companies.

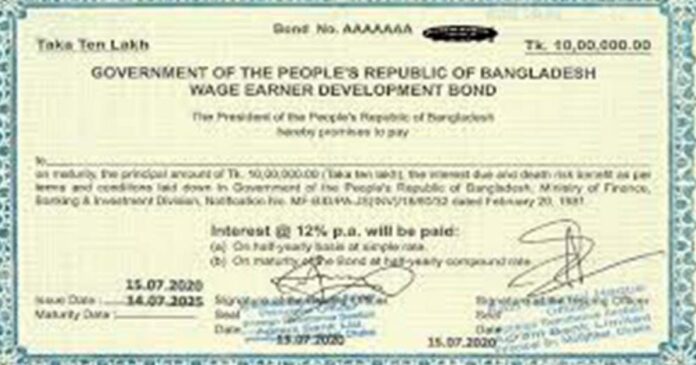

It is known that, in the case of Wage Earner Development Bond, there will be no upper investment limit from now on, so non-resident Bangladeshis can invest any amount of money in this bond. In the case of Family Savings Bonds, Pensioner Savings Bonds, Quarterly Profit Based Savings Bonds, Wage Earner Development Bonds, US Dollar Premium Bonds and US Dollar Investment Bonds under the 'National Savings Scheme', the principal amount invested can be automatically reinvested.

On the other hand, five-year Bangladesh Savings Papers and Post Office Savings Bank- Term Accounts will have the benefit of reinvesting the original investment with profit. In case of investment in Wage Earner Development Bonds, remittances brought in properly once can be invested in one period and reinvested in two more periods i.e. in three periods for a total of 15 years.

In the case of US Dollar Premium Bonds and US Dollar Investment Bonds, remittances duly brought can be invested once and reinvested four more times—that is, for a maximum of five consecutive terms for a total of 15 years.

Withdrawal of ceiling on investment in Wage Earner Development Bonds, US Dollar Premium Bonds and US Dollar Investment Bonds under the National Savings Scheme and provision of automatic reinvestment facility in Savings Bonds and facility of investment in Wage Earner Bonds for Bangladeshi Mariners, Pilots and Cabin Crew are also available to all expatriate Bangladeshis in large amounts of foreign currency appropriately. The Department of Internal Resources believes that the economic development of Bangladesh will be accelerated by importing and investing in Bangladesh.

Incidentally, as per the Wage Earners Development Bond Rules, 1981 (amended on 23 May 2015), any amount of money was allowed to be invested. During the outbreak of Covid-19, the IRD, through a notification on December 3, 2020, set a combined investment limit of one crore foreign currency equivalent in Wage Earners Development Bonds, US Dollar Premium Bonds and US Dollar Investment Bonds. Then on April 4, 2022, the cap on US dollar premium bonds and US dollar investment bonds was lifted.