Despite various initiatives, universal pension is not getting the desired response. Although there was a lot of interest in the beginning, the picture is different now. The number of its registrants is decreasing day by day. As a result, subscribers to the public pension scheme are very worried about its future.

Although the Ministry of Finance said on behalf of the government, the current interim government will continue this scheme made by Sheikh Hasina's government. Earlier, a campaign was conducted to get interested in this matter, but after the change of government on August 5, the authorities could not even campaign in that way.

This information is known from the sources of the Ministry of Finance.

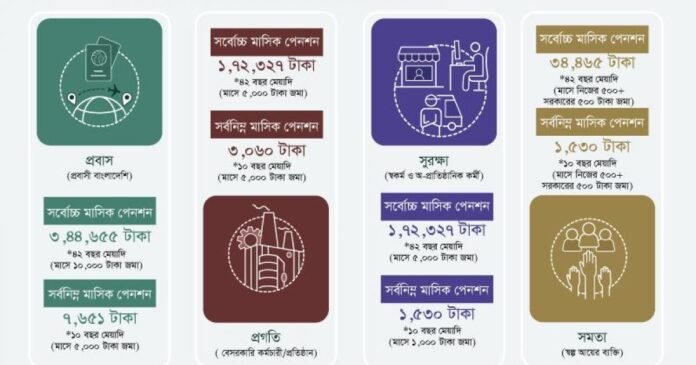

According to the Ministry of Finance, the government launched the universal pension system with four schemes on August 17, 2023 in a hurry to keep the promise before the National Assembly elections held in January this year. Although the government tried to promote the issue, the schemes failed to attract people in the last 14 months. So far 3 lakh 72 thousand 155 people have registered in all the schemes. Out of this only 2 lakh 85 thousand 884 registered in Samata scheme. The rest is in the remaining three schemes. A large number of people in the country are still not aware about this initiative of the government. It is being said that there is uncertainty as to whether the money invested will be returned or not.

Analysts say the risk will increase if pension scheme funds are held under government control. A separate organization is needed for this.

Sources in the Ministry of Finance said that the government is going to add the facility of paying a lump sum as gratuity from the age of 60 to popularize the universal pension benefits among the common people and to attract the people. Apart from this, health insurance benefits are being included under the universal pension system. Still the customers are not increasing at the desired rate. When the matter came to the attention of the government, on October 14, the chairman of the board of directors and financial adviser Dr. These decisions have been taken to popularize the universal pension system by analyzing the universal pension system in a meeting held under the chairmanship of Salehuddin Ahmed.

According to the latest data available from the website of the National Pension Authority, a total of 372,155 subscribers have registered in four schemes of universal pension till October 15. But majority of them are old registrants and hardly any new registrants.

The pension authority says that earlier the enrollment was regular. After the change of government, the pension authority could not go to campaign. Due to this the enrollment is less this time. However, the board of directors also advised the pension authority to attract customers. The board also said that if any changes are required from time to time then that opportunity is also there.

According to the relevant sources, to attract the common people to the universal pension system, all those who will be included in the universal pension system will get health insurance benefits. The National Pension Authority has started the analysis of how much money will be paid to the pensioners for gratuity and how much the monthly pension will be reduced.

Sources also say that currently there is no insurance connection with the subscription of the scheme in the country, but there is in different countries of the world. It is said that if it is found that there is a need to add insurance, it is convenient for the pensioners and the pensioners also want to do so or it will increase the number of subscribers, then the pension authority can bring changes here. For example, if a worker meets with an accident, his contribution will stop. So if there is insurance, he may get that insurance benefit from there. Besides, the age of getting pension is increased in different countries of the world. It is known that such changes may also come. Everything is being done to attract the common man to the universal pension system.

Sources in the Ministry of Finance and the Pension Authority said that although the public pension system was launched mainly to attract expatriates and people employed in the private sector, the schemes are not able to attract them. The number of registrants in the three schemes launched for expatriates and those employed in the private sector is only 86,494. Many of them do not pay installments after one or two months after registration.

Government policymakers had hoped that the public pension system would attract huge expatriate interest. This will ensure the financial security of the expatriates in their final life, as well as the government will be able to earn a large amount of foreign exchange through the payment of public pensions during the dollar crisis. But the inclusion rate in the expatriation scheme is most disappointing. Only 910 expatriates have been included in the scheme in the last 14 months.

22 thousand 410 people registered under Pragati scheme for private sector employees and 63 thousand 174 people registered under Suraksha scheme for people working in informal sector or self-employed.

Samata Scheme is for the super poor. The monthly subscription of the participants in this scheme is Rs.1000, out of which Rs.500 is paid by the registrant and Rs.500 by the government. Even though it is meant for the very poor, others are also joining this scheme in the greed of getting a subsidy of Rs 500 per month from the government. The list of registrants in Samata Scheme will be verified. Among these, those who are not ultra-poor or are considered ineligible to join the scheme, will be taken out of the equality scheme and transferred to another scheme.

When asked about this, Golam Mostafa, a member of the National Pension Authority, said, “We are thinking of conducting multi-faceted activities to increase confidence among the common people.” As part of this, we are thinking about giving gratuity and insurance benefits. How other countries of the world are paying gratuity will be examined and presented to the Advisory Council meeting with the approval of the Finance Advisor. A provision for payment of one time gratuity will be added if the Advisory Council agrees. However, he also said that the decision on the one-time payment of gratuity has not been finalized yet.

Finance advisor. Salehuddin Ahmed said that the universal pension program is not stopped even if it is somewhat stagnated. The current government has no plan to stop this program. The public pension system will continue as usual. Its facilities are also being extended.

On February 17, 2022, the then Prime Minister of the country, Sheikh Hasina, after presenting the prepared strategy paper on the universal pension system at the Ganabhaban, directed the Finance Ministry to enact a law for this new pension system as soon as possible. Pursuant to this directive, the draft Universal Pension Act was released on March 30, 2022.

Former Finance Minister AHM Mustafa Kamal announced on 9 June 2022 that a universal pension system would be introduced in the fiscal year 2023-2024. On June 23, 2023, the National Pension Authority was constituted to implement the universal pension system.

Former Prime Minister Sheikh Hasina inaugurated the universal pension system on August 17 of that year in line with the promise that the universal pension would be introduced in July 2023.

Read more:

Universal Pension: How to Apply?

Universal pension subscription can be paid through mobile banking, the charge is 70 paisa

Public Pension Scheme: This time financial institutions are also directed to participate

The benefits that private sector employees will get in the public pension scheme